Last Updated On 6 December 2022, 8:19 PM EST (Toronto Time)

In the beginning of 2022, IRCC updated online processing tool, to offer accurate information on processing timelines. Immigration Minister Sean Fraser announced this update on March 31, 2022, to improve Canadian immigration system. This article enlists the latest processing times from the IRCC as of November 30, 2022.

The immigration backlog in Canada has decreased from 1.49 million on September 30, 2022 to 1.2 million as of October 31, 2022. IRCC updated this data on November 16, 2022. Furthermore, 1.04 million applications were still being processed within IRCC service standards. So, in total, IRCC had approximately 2.2 million applications under processing as of October 31.

What Updates Does the Processing Time Include

The processing period begins when the application is received by IRCC and concludes when the immigration officer makes a decision on the application. IRCC bases processing time on the time they take to process prior similar applications. Furthermore, the processing time may differ depending on whether the application was filed on paper or online.

These processing times are designed to offer new weekly timelines from the last 6 months’ data. Furthermore, it correlates the application volume with operational issues to assist future immigrants in better planning their journey.

Processing Times for Citizenship & PR cards

| Application Type | Current Processing Time | Change From Last Week |

|---|---|---|

| Citizenship grant | 24 months | No Change |

| Citizenship certificate (proof of citizenship) | 16 months | No Change |

| Resumption of citizenship | 34 months | No Change |

| Renunciation of Citizenship | 17 months | No Change |

| Search of citizenship records | 15 months | No Change |

| New PR card | 91 days | – 11 Days |

| PR card renewals | 89 days | – 1 Day |

Processing Time for Family Sponsorship

| Application Type | Current Processing Time | Change From Last Week |

|---|---|---|

| Spouse or common-law partner living outside Canada | 20 months | No Change |

| Spouse or common-law partner living inside Canada | 14 months | No Change |

| Parents or Grandparents PR | 37 months | No Change |

- Click here for November 22 processing update!

- Canada Immigration Backlog At 1.2 Million – Latest IRCC Data

Processing time for Canadian Passport

| Application Type | Current Processing Time | Change From Last Week |

|---|---|---|

| In-Canada New Passport (Regular application submitted in person at Service Canada Centre – Passport services) | 10 business days | No Change |

| In-Canada New Passport (Regular application submitted by mail to Service Canada Centre) | 20 business days | No Change |

| In-Canda Urgent pick-up | By the end of next business day | No Change |

| In-Canada Express pick-up | 2-9 business days | No Change |

| Regular passport application mailed from outside Canada | 20 business days | No Change |

Processing time for Economic Class

| Application Type | Current Processing Time | Change From Last Week |

|---|---|---|

| Canadian Experience Class (CEC) | 19 months | No Change |

| Federal Skilled Worker Program (FSWP) | 27 months | No Change |

| Federal Skilled Trades Program (FSTP) | 51 months | + 2 months |

| Provincial Nominee Program (PNP) vis Express Entry | 14 months | No Change |

| Non-Express Entry PNP | 22 months | No Change |

| Quebec Skilled Worker | 22 months | No Change |

| Quebec Business Class | 65 months | No Change |

| Federal Self-Employed | 42 months | No Change |

| Atlantic Immigration Pilot (AIP) | 14 months | No Change |

| Start-Up Visa | 31 months | No Change |

- You may also like:

- New Canada Immigration Levels Plan 2023-2025

- Here Is IRCC Minister Response On The Future Of TR2PR

- Canada Immigration Backlog At 1.2 Million – Latest IRCC Data

- Click here for November 22 processing update!

Processing Time for Temporary Residence Application

| Application Type | Current Processing Time | Change From Last Week |

|---|---|---|

| Visitor visa outside Canada | Varies by country India: 162 days Nigeria: 184 Days United States: 56 Days Pakistan: 227 Days Philippines: 118 Days UAE: 198 Days Bangladesh: 149 Days Sri Lanka: 215 Days United Kingdom: 135 Days | – 1 Day for India – 5 Days for Nigeria – 4 Days for United States & Philippines + 7 Days for Pakistan + 2 Days for UAE + 30 Days for Bangladesh No Change for Sri Lanka – 10 Days for UK |

| Visitor visa inside Canada | Online: 22 days Paper-Based: 45 days | + 2 Days for online No Change for paper-based |

| Parents or Grandparents Supervisa | Varies by country India: 171 days Nigeria: 240 Days United States: 325 Days Pakistan: 242 Days Philippines: 180 Days UAE: 185 Days Bangladesh: 165 Days Sri Lanka: 270 Days United Kingdom: 185 Days | + 12 Days for India + 2 Days for Nigeria – 143 Days for United States – 4 Days for Pakistan – 2 Days for Philippines + 5 Days for UAE – 31 Days for Bangladesh – 12 Days for Sri Lanka + 7 Days for UK |

| Visitor Extension (Visitor Record) | Online: 204 days Paper-Based: 165 days | – 1 Days (Online) – 2 Days (Paper-Based) |

| Study Permit Outside Canada | 11 Weeks | – 1 Week |

| Study Permit Inside Canada | 4 Weeks | No Change |

| Study Permit Extension | Online: 70 Days Paper-Based: 101 Days | + 1 Day (Online) + 3 Days (Paper-Based) |

| Work Permit Outside Canada* | Varies by country India: 13 Weeks Nigeria: 31 Weeks United States: 14 Weeks Pakistan: 47 Weeks Philippines: 11 Weeks UAE: 27 Weeks Bangladesh: 38 Weeks Sri Lanka: 35 Weeks United Kingdom: 10 Weeks | No Change for India & United States – 1 Week for Nigeria, Philippines, United Kingdom – 11 Weeks for Pakistan – 5 Weeks for UAE + 12 Weeks for Bangladesh + 4 Weeks for Sri Lanka |

| Work Permit Inside Canada | Online: 166 Days Paper-Based: 84 Days | – 2 Days (Online) No Change for paper-based |

| International Experience Canada (Current Season)** | 5 Weeks | – 1 Week |

| Electronic Travel Authorization (eTA) | 5 minutes | No Change |

- *Applications for critical occupations are being prioritised. If you are not applying for a job in a critical occupation, your processing time may be longer than shown above.

- **IEC 2022 (International Experience Canada) Ended On Oct 17

Source: IRCC

New Canada Carbon Rebate Payment Beginning April 15

New Minimum Wage In Canada and 5 Provinces

New Ontario Measures To Align International Students With In-Demand Jobs

Canada Permanent Resident Travel Document (PRTD)

Asylum Claims by International Students in Canada Rise by 1500%

Canada Considering 30-Hour Work Policy For International Students

New Canada Work Permit Median Wage Increase Effective April 2

New Canada Immigration Processing Fees Increase 2024

Tax Deadline 2024 Canada and Important CRA Dates

New Canada Work Permit Innovation Stream Pilot Is Now Open

New Rules For International Students In Canada 2024

New Canada Revenue Agency (CRA) Tax Rules 2024

A Valid Job Offer For Express Entry To Increase CRS Score

Most Dangerous Cities in Canada 2024

New Ontario Minimum Wage Increase, Effective October 1

Canada Passport Ranking 2024: Full List of Visa-Free Countries

- Can international students in Canada work more than 40 hours?

The full-time work hours policy by Immigration, Refugees, and Citizenship Canada (IRCC) for certain international students in Canada will come to an end on April 30, 2024.

Multiple readers have reached out to inquire about the number of hours international students can work after April 30th and if students in Canada can work more than 40 hours or not.

In this article, we will delve into important information on working hours for international students in Canada and scenarios where students can work more than 40 hours.

International Students Working Hours After April 30th

Under the temporary public policy that IRCC introduced, only a specific cohort of international students were qualified to work full-time until April 30. Click here to see the eligibility for full-time work.

This full-time work hours policy is not expected to extend beyond this date, but IRCC did mention that they are looking into future options such as increasing off-campus employment hours for students to 30 hours per week.

While all these future options are still being explored, there is a possibility of an announcement around April 30th regarding them. Or it may be after that since IRCC usually has delayed responses.

Or, in the worst case, there may not be any change to the work-hour policy for students at all.

Generally, students will only be allowed to work off campus for up to 20 hours per week while their class is in session, until or unless a new 30-hour work-hour policy is introduced.

You can work as an international student in Canada only if your study permit specifies that you can work on or off campus.

So it is important to read the conditions mentioned on your permit.

Can International Students Work More Than 40 Hours in Canada?

During scheduled breaks, like winter and summer holidays, as well as during fall or spring reading week, students can work full-time off campus.

It’s also possible to take on more hours or work two part-time jobs that add up to this full-time work.

It is important to note that students are expected to maintain their full-time student status before and after the break.

Students cannot work during the gap preceding their first semester of study.

Apart from the above-listed scenarios, students are allowed to work full-time even while their class is in session if they are employed by an employer in an on-campus work setting.

What does on-campus work include?

“On-campus” indicates that you can work in any of the buildings on your school campus.

If your school has multiple campuses, you may only be able to work on the one where you are currently enrolled.

As per IRCC, an “on-campus” employer can be

- the school,

- a faculty member,

- a student organization,

- yourself if you run a business that is physically located on-campus (for example, you own a coffee shop on campus),

- a private business, or

- a private contractor that provides on-campus services to the school.

How many hours constitute full-time work?

As per the IRCC, there is no standard amount of hours per week that constitutes ‘full-time’ work.

However, your employer(s) must comply with all provincial regulations governing overtime compensation and shift breaks.

What happens if a student works more than 20 hours off-campus while class is in session?

Working more than 20 hours per week constitutes a violation of the student’s study permit requirements.

By doing so, students risk losing their status and can be denied a study or work permit in the future.

They may also be asked to leave the country.How many hours student can work in Canada?

20 hours per week during regular academic sessions and full-time during scheduled breaks.

There is no set definition for “Full-time,” so students can work any number of hours during scheduled breaks.Jump Back to Top

student working hours in Canada, ircc updates for international students working hours, ircc new updates for international students, ircc student working hours, canada immigration news for international students, ircc news for international students working hours,

- New Canada Work Permit Innovation Stream Pilot Is Now Open

On April 15, Immigration, Refugees, and Citizenship Canada (IRCC) announced a new 2-year Innovation Stream Pilot via the Global Hypergrowth Project.

This new Innovation Stream Pilot will allow certain Canadian companies to bring in highly skilled foreign workers on work permits without needing an LMIA (Labour Market Impact Assessment).

Jobs in National Occupational Classification (NOC) categories 0, 1, 2, or 3 (Training, Education, Experience, and Responsibilities) are considered high-skilled jobs.

Furthermore, family members of these foreign workers will be eligible for an open work permit, allowing them to work for almost any employer in Canada.

The Innovation Stream is scheduled to continue for two years, ending on March 22, 2026, unless there are any changes.

On June 27, 2023, the Immigration Minister announced the Canada Tech Strategy and as part of it, the minister announced that a new innovation stream would be introduced to bring talented workers to help build innovative businesses.

Innovation Stream Pilot Eligibility Criteria

To apply for a work permit under the Innovation Stream Pilot, foreign nationals inside or outside Canada need a job offer from one of the eligible employers under the Global Hypergrowth Project.

Applicants need to fill out their work permit application using the IRCC Secure Account.

The job offer must fall under a TEER 0, 1, 2, or 3 occupation as per the National Occupational Classification.

Offered wages must be equal to or higher than the median hourly wages set for the region.

If the position is covered by a bargaining agreement the wage offered must also meet the standards outlined in that agreement.

Additionally the job offer should state that the employer will review wages on the first day of work and annually by January 1 to ensure they remain competitive throughout employment.

Immigration officers must be satisfied that applicants have the skills, for the job they are applying for.

They should consider whether applicants meet the education and experience requirements specified in the National Occupational Classification for their offered occupation.

Full List of Companies in Canada Eligible To Hire Through Innovation Stream

There are currently eight companies that are eligible to hire foreign nationals (inside or outside Canada) without needing an LMIA via the Innovation Stream, as listed below:

- Ada Support Inc.

- AlayaCare

- CellCarta

- Clarius Mobile Health

- Clio

- Duchesnay Pharmaceutical Group (DPG)

- Lightspeed Commerce

- Vive Crop Protection

What is the Global Hypergrowth Project?

The Global Hypergrowth Project (GHP), a new scale-up service from the Canadian government, aims to help Canadian-based businesses develop farther and faster.

Through the combined resources of its government partners, this project helps customize support to meet the individual needs of each participating company, providing solutions that are as distinctive as the companies themselves.What is an employer-specific work permit?

An employer specific work permit, in Canada allows you to work based on the terms specified on your permit including details, like the name of your employer, duration of employment and authorized work location.Click here for more details on this program.

Jump Back to Top

- Tax Deadline 2024 Canada and Important CRA Dates

Tax Deadline 2024: Canadians are already filing their taxes, while some are still preparing to complete this important civic responsibility.

The deadline is drawing near, so it’s critical to remember the important dates and instructions to avoid any last-minute scrambling or fines.

Filing your return on time allows you to avoid interest and penalties and receive your refund earlier.

To make this season less stressful, we’ve compiled a list of all the main deadlines regarding the Canadian tax deadline for 2024.

Personal Tax Deadline 2024

The deadline for filing individual taxes is approaching, with a due date set for April 30, 2024.

The Canada Revenue Agency (CRA) typically expects individual taxpayers to file their tax returns by April 30 of each year.

If April 30 falls on a weekend, the CRA extends the deadline to the next working day.

This year, CRA has also launched its NETFILE service on February 19, 2024, to electronically receive submitted returns.

You must receive or postmark mailed responses by the due date and send electronic returns by midnight local time on the due date.

You may also like: New Tax Brackets in Canada For 2024

Self-Employed/Business Tax Deadline: 2024

If you, your spouse, or your common-law partner operated a business in 2023 and incurred business expenses:

- relating mostly to a tax shelter investment, your 2023 return must be filed by April 30, 2024

- other than those relating mostly to a tax shelter investment, your 2023 return must be filed by June 15, 2024

However, if you have a balance due in 2023, you must pay it on or before April 30, 2024.

Some incorporated businesses, however, may choose to use a non-calendar fiscal year, in which case their returns are due six months after the fiscal year ends.

You may also like: New Canada Revenue Agency (CRA) Tax Rules 2024

Important CRA dates and deadlines for 2024

We’ve compiled a list of all the dates you’ll need to remember during the tax season.

Filing dates for 2023 taxes

- Apr 30, 2024 : Deadline to file your taxes

- Jun 15, 2024: Deadline to file your taxes if you, your spouse, or your common-law partner are self-employed

Payment date for 2023 taxes

- Apr 30, 2024: Deadline to pay your taxes

What happens if you file your personal taxes late?

Filing your taxes late, even if you have received a refund or do not owe any further tax, will result in no fees or penalties.

If you owe money and file late, the CRA will impose a five percent penalty on the taxes owed, plus an additional percent for each month late for up to 12 months.

Individuals must pay their taxes to the CRA on the same day that their tax returns are due.

If you are unable to pay the whole amount, the CRA will accept late payments but apply compound daily interest on all amounts owed.Important: For your 2023 taxes, the CRA has raised the interest rate on delinquent taxes to 10%, which might have a major impact on your finances. Careful tax planning can help alleviate the burden.

What happens if I am self-employed and file taxes late?

As a small business owner, you may be required to file additional returns, including payroll, GST/HST payments and withholdings.

Failure to meet the CRA’s payroll requirements incurs penalties and interest; there are numerous sorts of penalties for payroll accounts.

Failure to deduct might result in a 10% penalty for the first failure, which increases to 20% for subsequent failures.

Late filing or non-payment penalties begin at 3% and increase to 20%.What are due dates for tax instalment payments?

If you pay in installments throughout the year to prevent a hefty bill at tax time, you will have four due dates.

Whether you are self-employed or employed by someone else, you must make your installment payments on March 15, June 15, September 15, and December 15 of each year.What if I don’t file and pay my taxes on time?

To avoid interest and penalties, as well as disruptions to your benefit and credit payments, file your return early or before the due date.When is the tax deadline for 2024?

2024 tax filing deadline is April 30th.Jump Back to Top

tax deadline 2024, tax filing deadline 2024, tax deadline 2024 Canada, tax filing deadline 2024 Canada, Canada tax deadline 2024, Canadian tax brackets, CRA tax, income tax, CRA login, Canadian immigration news, deadlines for 2024, tax filing deadline,

- New GST Payment Of Up To $650 Is Now Being Sent

The Canada Revenue Agency (CRA) is now sending out the quarterly HST/GST payment to eligible Canadian taxpayers, beginning April 5, 2024.

Individuals and families with low or moderate incomes receive the GST/HST credit, a non-taxable sum, four times a year to help balance the goods and services tax and harmonized sales tax (GST/HST) they pay.

This article delves into HST/GST payment eligibility criteria, how to get GST/HST credit, how much HST or GST can you get, how are GST/HST payments calculated, what are the upcoming payment dates in 2024, and other upcoming federal government payments in April 2024.

Eligibility for HST/GST Payment

If you are a Canadian resident for income tax purposes at the beginning of the month in which the CRA makes a payment, you are eligible for this credit if you meet the below-listed eligibility criteria:

You must be at least 19 years old in the month before the CRA issues your quarterly payment.

‘OR’

If you are under the age of 19, you must meet at least one of the following requirements at the same time:

- You have (or had) a spouse or common-law partner.

- or

- You are a parent who lives (or was living) with their child.

How do I get GST/HST credit?

In most cases, tax paying Canadian residents automatically get GST/HST credit, as well as any applicable provincial and territorial credits, even if they did not make any money that year.

New Tax Bracket Canada 2024 However, newcomers to Canada do not need to file their first tax return before you start receiving the GST/HST credit.

Newbies to Canada can claim the GST/HST credit through one of the two procedures described below.

If you do not have any children,

Send a completed Form RC151, GST/HST Credit and Canada Carbon Rebate Application for Individuals Who Become Residents of Canada, for the year you become a tax-paying resident.

If you have children,

To apply for all child and family benefits, complete and submit Form RC66, Canada Child Benefits Application.

To record your citizenship and residency status, as well as your Statement of Income, you must also complete Form RC66SCH, Status in Canada and Income Information for the Canada Child Benefits Application.

How are GST/HST payments calculated?

For the 2022 base year (payment period from July 2023 to June 2024), you could receive up to

$496 if you’re single.

$650 if you are married or have a common-law partner

$171 for every child under the age of 19.How are GST/HST payments calculated?

For the 2022 base year (payment period from July 2023 to June 2024), you could receive up to

$496 if you’re single.

$650 if you are married or have a common-law partner

$171 for every child under the age of 19.How are GST/HST payments calculated?

Your GST/HST credit payments are calculated based on your adjusted family’s net income:

If you’re single, the amount from line 23600 of your income tax return, or what it would be if you completed one.

If you have a spouse or common-law partner, your net income is pooled to calculate your family net income, which includes the number of children under 19 registered for the Canada child benefit and GST/HST credit.

To estimate your GST/HST credit, utilize the official CRA Child and Family Benefits Calculator.What are the GST payment dates in 2024?

The CRA makes the following quarterly GST payments on the dates listed below:

April 5, 2024

July 5, 2024

October 4, 2024

If the fifth falls on a Saturday, Sunday, or federal statutory holiday, we make the payment on the last business day before the fifth.

If you do not receive your payment within 10 working days of the 5th day of the above-mentioned schedule, please contact CRA at 1-800-387-1193.What federal payments are scheduled for April 2024?

GST/HST payment is due on April 5

Canada Carbon Rebate (CCR) (formerly known as Climate action incentive payment) on April 15

Canada Child Benefit (CCB) on April 19

gst rebate 2024, new cra gst payments 2024, grocery rebate canada, gst increase 2024, gst dates, gst canada, gst 2024, gst april 2024, gst payment april 2024, gst 2024, gst hst payment dates, gst calculator,

- You have (or had) a spouse or common-law partner.

- New Minimum Wage In Canada and 5 Provinces

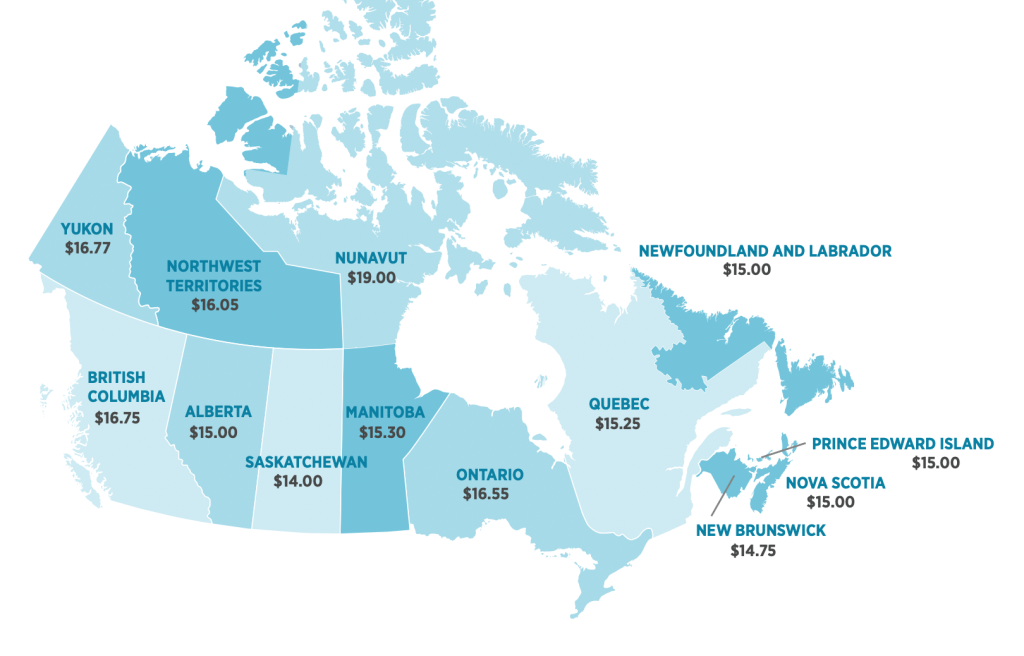

The new minimum wage in Canada and five Canadian provinces/territories (Yukon, Nova Scotia, New Brunswick, Prince Edward Island, and Newfoundland and Labrador) takes effect today, April 1, 2024.

To keep up with inflation, the federal national minimum wage in Canada is now $17.30 per hour, an increase from $16.65 per hour.

All federally regulated commercial sectors in Canada, including banking, postal and courier services, and interprovincial air, rail, road, and ocean transportation, must pay the federal minimum wage.

However, critics continue to attack the new minimum wage for falling short of actual living wages in various parts of Canada.

New minimum wage in five Canadian provinces

Today (April 1, 2024), a new minimum wage will take effect in five Canadian provinces.

The Prince Edward Island (PEI) minimum wage will rise by 40 cents per hour to $15.40 per hour.

The new Nova Scotia minimum wage, which goes into effect today, will be $15.20 an hour.

New Brunswick’s minimum wage is now officially set at $15.30 per hour, effective April 1, 2024, up from $14.75.

Also, the minimum wage in Newfoundland and Labrador has now increased by 60 cents to $15.60 per hour.

Furthermore, the Yukon minimum wage will increase by 82 cents to $17.59 per hour.

Official minimum wage in Canada and the upcoming salary schedule

Province / Territory Current hourly Minimum Wage Next Raise Schedule Canada (only federally regulated private sectors) $17.30 April 1, 2025 Yukon $17.59 April 1, 2025 Newfoundland and Labrador $15.60 April 1, 2025 Nova Scotia $15.20 October 1, 2024 Prince Edward Island $15.40 April 1, 2025 New Brunswick $15.30 April 1, 2025 Nunavut $19.00 Yet to be decided British Columbia $16.75 $17.40 per hour, effective June 1, 2024 Ontario $16.55 minimum wage is to be revised on October 1, 2024 Northwest Territories $16.05 Yet to be decided Manitoba $15.30 $15.80 per hour, effective October 1, 2024 Quebec $15.25 $15.75 per hour, effective May 1, 2024 Alberta $15.00 Yet to be decided Saskatchewan $14.00 $15 per hour, effective October 1, 2024 minimum wage in Canada Minimum Wage in Canada Does Not Match The Living Wages

Official minimum wages in Canada and its provinces continue to fall short of the practical living wages in the country’s largest cities.

The living wage is defined as what individuals must earn to cover the true costs of living in their neighbourhood, and it is based on community-specific data.

The living wages in major locations in Canada are listed below.

City/Region Living Wage

Rates in 2023Canmore 38.80 Clayoquot Sound 26.51 Halifax 26.50 Daajing Giids 26.25 Golden 25.78 Metro Vancouver 25.68 Sunshine Coast 25.61 Greater Victoria 25.40 Annapolis Valley 25.40 Cowichan Valley 25.20 Powell River 25.06 Southern 25.05 GTA 25.05 Jasper 24.90 Revelstoke 24.60 Kelowna 24.60 Fort McMurray 24.50 Northern 24.30 St. Albert 23.80 Calgary 23.70 Nanaimo 22.87 Cape Breton 22.85 Grey Bruce Perth Huron Simcoe 22.75 Columbia Valley 22.63 Edmonton 22.25 Prince George 22.09 Comox Valley 22.02 Ottawa 21.95 High River 21.70 Lac La Biche County 21.60 Trail 21.55 Nelson 21.14 Stony Plain 21.10 Spruce Grove 21.00 Kamloops 20.91 Dufferin Guelph Wellington Waterloo 20.90 Hamilton 20.80 Fraser Valley 20.66 Dawson Creek 20.64 Lethbridge 20.60 East 20.60 Brant Haldimand Norfolk Niagara 20.35 North 19.80 Drayton Valley 19.55 Winnipeg 19.21 Brooks 19.05 Saskatoon 18.95 Grande Prairie 18.90 London Elgin Oxford 18.85 Red Deer 18.75 Southwest 18.65 Regina 17.80 Thompson 17.48 Medicine Hat 17.35 Brandon 15.69 Living Wage Rates in Canada What is the federal minimum wage?

In 2021, the Canadian government implemented a federal minimum wage.

It is changed annually to reflect Canada’s annual average consumer price index from the preceding calendar year.

The federal minimum wage is now $17.30 per hour, effective April 1, 2024.When is the minimum wage in Ontario going up?

The minimum wage in Ontario will rise to $17.20 on October 1, 2024.When will Alberta raise the minimum wage?

Alberta’s minimum wage has remained steady since 2018, and it was the highest in 2018.

However, the province has not made any changes to the minimum wage since then and there has been no indication by the provincial government until now.What is Nova Scotia’s minimum wage?

The minimum wage in Nova Scotia is $15.20. On October 1, 2024, Nova Scotia may revise the minimum wage again.When does the federal minimum wage in Canada increase?

Every year, on April 1, Canada revises the federal minimum wage based on the Consumer Price Index (CPI).When will the BC minimum wage increase in 2024?

B.C. will be raising the minimum wage to $17.40 per hour on June 1, 2024.Jump Back to Top

new minimum wage in Canada 2024, new minimum wage in Ontario 2024, federal minimum wage 2024, b.c. minimum wage increase 2024, minimum wage 2024, minimum wage increase 2024, nova scotia minimum wage,

- New Ontario Minimum Wage Increase 2024

Yes, you heard it right. It is now officially confirmed that the new Ontario minimum wage increase of 2024 will come into effect on October 1.

The Ontario government will be raising the minimum wage from $16.55 to $17.20 per hour beginning October 1, 2024.

This 3.9% annualized salary rise, based on the Ontario Consumer Price Index (CPI), raises Ontario’s minimum wage to the second highest among major Canadian provinces.

British Columbia will have the highest minimum wage of $17.40 per hour effective June 1, 2024.

The minimum wage rates are adjusted annually to reflect the rate of inflation. If the inflation rate changes, the new rate will be publicized on or before April 1 and take effect on October 1.

So a worker earning the basic minimum wage and working 40 hours per week might expect an annual pay increase of up to $1,355.

In 2023, 935,600 workers earned $17.20 or less per hour.

Apart from this general wage increase, special minimum wage rates for students and homeworkers (working from home) will also increase effective October 1.

Special Ontario Minimum Wage will also increase

Students under the age of 18 who work 28 hours or less per week throughout the school year or during school vacations or summer holidays will see their hourly rate increase from $15.60 to $16.20.

The minimum wage for homeworkers in Ontario, those who do paid work from home, will rise from $18.20 to $18.90 per hour.

Students who work as homeworkers, regardless of age (including those under 18), must receive the minimum wage set for homeworkers.

The minimum wage for hunting, fishing, and wilderness guides will increase from $82.85 to $86 per day when working fewer than five consecutive hours and from $165.75 to $172.05 per day when working five or more hours.

After 365 days, on October 1, 2025, Ontarians can expect a further hike based on inflation, which will take the minimum wage close to $18 per hour.

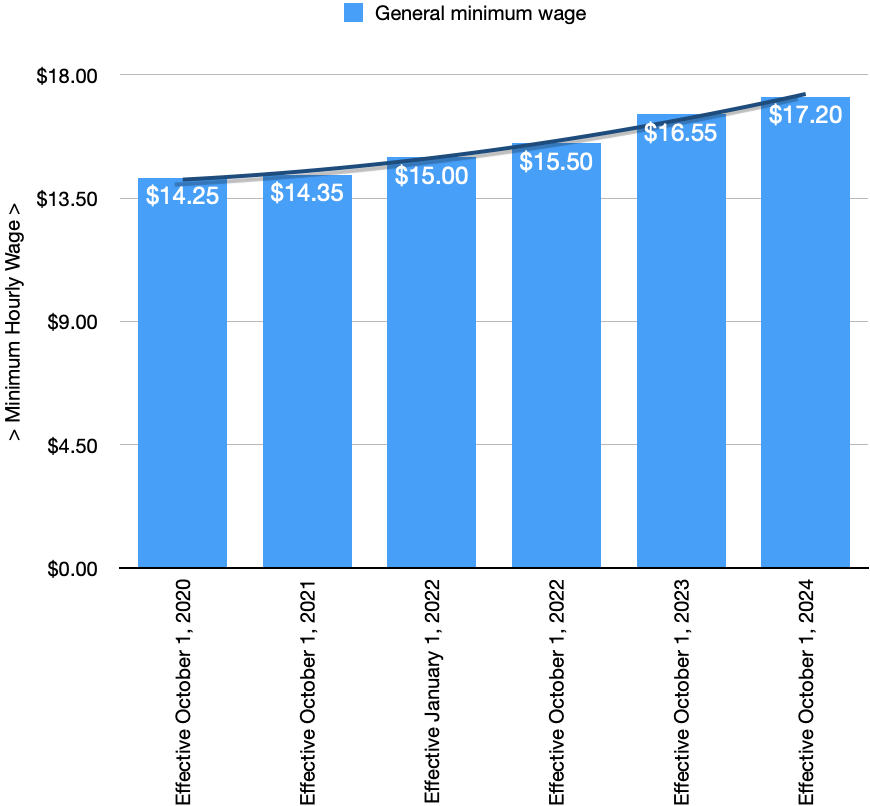

Ontario minimum wage history

Although it brings some relief to workers in Ontario, the minimum wage has increased only $2.95 hourly in the last four years.

Minimum wage rate Effective October 1, 2024 Effective October 1, 2023 Effective October 1, 2022 Effective January 1, 2022 Effective October 1, 2021 Effective October 1, 2020 General minimum wage $17.20 per hour $16.55 per hour $15.50 per hour $15.00 per hour $14.35 per hour $14.25 per hour Ontario Minimum Wage hikes since 2020

Similarly, the minimum wage under 18 in Ontario for students has only increased by $2.80 per hour since October 2020.

Minimum wage rate Effective October 1, 2024 Effective October 1, 2023 Effective October 1, 2022 Effective January 1, 2022 Effective October 1, 2021 Effective October 1, 2020 Student minimum wage $16.20 per hour $15.60 per hour $14.60 per hour $14.10 per hour $13.50 per hour $13.40 per hour Student minimum wage hikes Homeworkers (working from home) have seen the highest hourly rise of $3.20, from $15.70 per hour to $18.90 per hour.

Minimum wage rate Effective October 1, 2024 Effective October 1, 2023 Effective October 1, 2022 Effective January 1, 2022 Effective October 1, 2021 Effective October 1, 2020 Homeworkers wage $18.90 per hour $18.20 per hour $17.05 per hour $16.50 per hour $15.80 per hour $15.70 per hour Working from home, minimum wage Ontario Minimum Wage Still Short of Living Wages

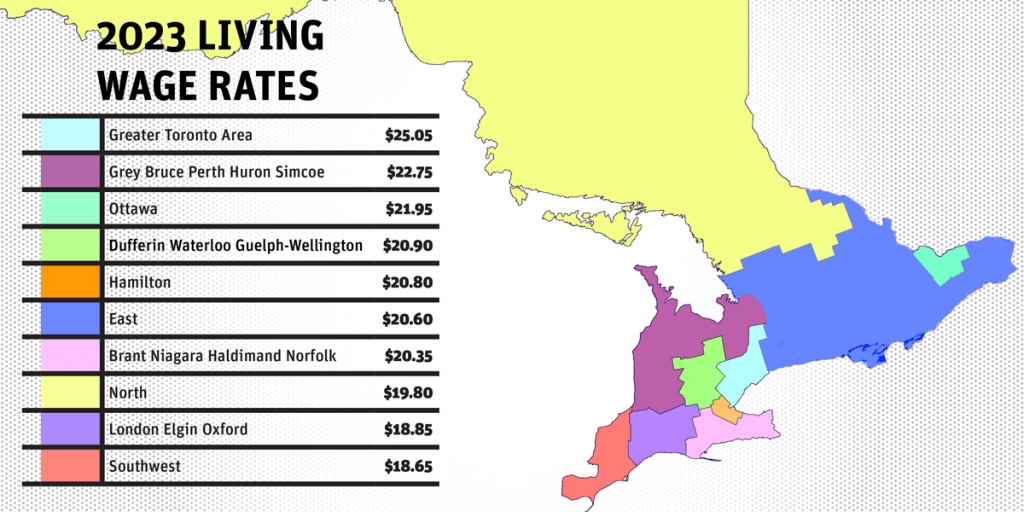

According to the latest report by the Ontario Living Wage Network, the average living wage in Ontario is almost $21 per hour ($20.97), but it exceeds $25 in the Greater Toronto Area (GTA).

The province has 868 certified living wage workplaces under 635 companies that voluntarily pay living wages rather than the minimum wage.

The Ontario Living Wage Network’s report provides the following breakdown of living wages in various regions of Ontario:

Region Living Wage Greater Toronto Area $25.05 Grey Bruce Perth Huron Simcoe $22.75 Dufferin Waterloo Guelph-Wellington $20.90 Brant Niagara Haldimand Norfolk $20.35 North $19.80 Ottawa $21.95 East $20.60 Hamilton $20.80 Southwest $18.65 London Elgin Oxford $18.85 Living Wage Rates in Ontario

What is the minimum wage in Ontario 2024?

The minimum wage in Ontario in 2024 is $16.55 per hour and it will increase to $17.20 per hour on October 1, 2024.When does the minimum wage go up in Ontario?

On October 1, 2023, the minimum wage in Ontario went up from $15.50 per hour to $16.55 per hour.When is Ontario minimum wage going up?

The Ontario minimum wage is going up on October 1, 2024, to $17.20 per hour from $16.55 per hour.Jump Back to Top

minimum wage in Canada, minimum wage Ontario 2024, minimum wage 2024, Minimum wage Ontario April 1, minimum wage Ontario under 18, minimum wage increase Ontario, April minimum wage 2024,

- New Ontario Sunshine List 2024

The provincial government released the new Ontario Sunshine List 2024 on March 27, and Ontario Power Generation employs five of the highest-paid public employees.

The official Sunshine List of Ontario 2024 lists all government employees paid more than $100,000 in 2023 and includes 300,570 names, up from 267,000 in 2022.

Based on the Sunshine List, the total compensation adds up to more than $38 billion in annual salaries paid to these executives.

Kenneth Hartwick, CEO of Ontario Power Generation (OPG), is again the highest-paid executive, earning little more than $1.9 million.

Another executive, Dominique Miniere, from the Ontario Power Generation (OPG), got nearly $1.2 million in salaries.

All five of the highest-paid executives in the public sector in 2023 worked for OPG.

Other top earners on the Sunshine list include:

- Ronald Cohn, President and CEO of the Hospital for Sick Children: $851,414

- Kevin Smith, President and CEO of the University Health Network: $844,992

- Phil Verster, Metrolinx CEO: $838,097

- Mark Fuller, President and CEO of Ontario Pension Board: $826,539

- Matthew Anderson, CEO of Ontario Health ($821,000)

Salaries Of Renowned Public Personalities in Sunshine List Ontario

Ontario Premier Doug Ford got $208,974 in salary during 2023, which is unchanged compared to 2022.

Interestingly, his salary is less than that of some of his staffers, which includes his chief of staff, who will earn around $324,000 in 2023.

Other publicly renowned personalities salaries in 2024 are listed below:

- $562,325 for TTC CEO Rick Leary

- $346,303 for Jamie Wallace, Ford’s former chief of staff and current CEO of Supplies Ontario.

- $464,148 for Dr. Kieran Moore, Chief Medical Officer of Health.

- $455,091 for Dr. Dirk Huyer, the Chief Coroner.

- $395,974 for Bonnie Lysyk, the Auditor General.

- $373,472 for Ontario Provincial Police Commissioner Thomas Carrique.

- $174,950 for Marit Stiles, Ontario NDP Leader

- $129,438 for Bonnie Crombie, Former Mississauga Mayor

List of the Top Public Sector Earners More Than $500K in Ontario.

Below is the list of 106 public sector workers that earned more than half a million annually in 2023.

Name Salary JobTitle Employer Kenneth Hartwick $1,925,372 President and Chief Executive Officer Ontario Power Generation Dominique Miniere $1,194,533 Chief Strategy Officer Ontario Power Generation Michael Martelli $972,747 Chief Projects Officer Ontario Power Generation Nicolle Butcher $894,783 Chief Operations Officer Ontario Power Generation Christopher Ginther $889,925 Executive Vice President Business Strategy and Commercial Management Ontario Power Generation Ronald Cohn $851,414 President and Chief Executive Officer The Hospital For Sick Children Kevin Smith $844,992 President and Chief Executive Officer University Health Network Phil Verster $838,097 President and Chief Executive Officer / Président et chef de la direction Metrolinx / Metrolinx Mark Fuller $826,539 President and Chief Executive Officer / Président et chef de la direction Ontario Public Service Pension Board (Ontario Pension Board) / Commission Du Régime De Retraite Des Fonctionnaires De L’Ontario (Commission Du Régime De Retraite D) Matthew Anderson $821,000 Chief Executive Officer/Président-directeur général Ontario Health / Santé Ontario Steve Gregoris $809,566 Chief Nuclear Officer Ontario Power Generation Jon Franke $803,730 Senior Vice President Pickering A Ontario Power Generation Jackie Schleifer Taylor $786,003 President and Chief Executive Officer London Health Sciences Centre Timothy Rutledge $771,236 President and Chief Executive Officer Unity Health Toronto Andy Smith $765,102 President, Chief Executive Officer Sunnybrook Health Sciences Centre Name Salary JobTitle Employer Alfred Hannay $709,582 President and Chief Executive Officer / Président et chef de la direction Ontario Lottery And Gaming Corporation / Société des loteries et des jeux de l’Ontario Gary Newton $705,928 President and Chief Executive Officer Sinai Health System David G. Vingoe $697,972 Chief Executive Officer / Chef de la direction Ontario Securities Commission / Commission des valeurs mobilières de l’Ontario David Graham $689,226 President and Chief Executive Officer Scarborough Health Network Lesley Gallinger $689,059 President and Chief Executive Officer / Président et chef de la direction Independent Electricity System Operator / Opérateur indépendant de réseau d’électricité Robert Macisaac $687,201 President and Chief Executive Officer Hamilton Health Sciences Birgit Betina Ertl-Wagner $682,450 Radiologist The Hospital For Sick Children Mark Knutson $682,378 Chief Enterprise Engineering and Chief Nuclear Engineer Ontario Power Generation Aida Cipolla $679,657 Chief Financial Officer and Senior Vice President – Finance Ontario Power Generation Altaf Stationwala $679,466 President and Chief Executive Officer MacKenzie Health Linda Mohri $675,832 Senior Vice President Clinical Care/Vice-Présidente Principale, Soins Cliniques Centre For Addiction And Mental Health Karli Farrow $668,325 President and Chief Executive Officer Trillium Health Partners Michelle DiEmanuele $663,841 Secretary of the Cabinet / Secrétaire du Conseil des ministres Trillium Health Partners Elizabeth Buller $657,635 President and Chief Executive Officer St. Joseph’s Healthcare Hamilton Gadi Mayman $651,417 Chief Executive Officer / Directeur général Ontario Financing Authority / Office ontarien de financement Name Salary JobTitle Employer Brian Golden $650,860 Professor of Strategic Management University Of Toronto Yung Wu $650,625 Chief Executive Officer MaRS Discovery District Cameron Love $647,124 President/Président The Ottawa Hospital / L’Hopital d’Ottawa Kenneth Dr. Boss $639,131 Psychiatrist/Psychiatre North Bay Regional Health Centre / Centre regional de sante de North Bay Mohit Bhandari $632,225 Professor McMaster University Barbara Collins $628,700 President and Chief Executive Officer Humber River Health Joao Amaral $628,091 Radiologist The Hospital For Sick Children Manohar Shroff $625,902 Radiologist The Hospital For Sick Children Sarah Downey $625,574 President and Chief Executive Officer / Présidente-directrice générale Centre For Addiction And Mental Health Dimitri Parra $616,550 Radiologist The Hospital For Sick Children Melissa Hogg $612,792 Chief Administrative and Ethics Officer Ontario Power Generation David Pichora $612,389 President and Chief Executive Officer \ Président-directeur Générale Kingston Health Sciences Centre Brian Silverman $611,828 Professor of Strategic Management University Of Toronto Daniel Cass $604,753 Executive Vice President Chief Medical Executive Sunnybrook Health Sciences Centre Subo Sinnathamby $601,856 Chief Projects Officer Ontario Power Generation Name Salary JobTitle Employer Doris Grinspun $601,376 Chief Executive Officer Registered Nurses Association Of Ontario Sharon Hodgson $596,392 Dean (Ivey Business School)/Lecturer University Of Western Ontario Tracey Macarthur $595,125 President and Chief Executive Officer / Présidente-directrice générale Centre For Addiction And Mental Health Johan Viljoen $587,406 Chief of Staff Executive Vice-President, Medical Affairs / Médecin-chef et vice-président directeur, Affaires médicales Niagara Health System Ronald Gagnon $585,695 President and Chief Executive Officer Grand River Hospital Corporation John Yoo $584,737 Dean/Professor/Medical Doctor University Of Western Ontario Brenda Macdonald $582,920 Senior Vice President New Growth and Commercial Management Ontario Power Generation Helen Branson $576,610 Neuroradiologist The Hospital For Sick Children Pradeep Krishnan $576,239 Radiologist The Hospital For Sick Children Alessandro Gasparetto $576,036 Radiologist The Hospital For Sick Children Prakash Muthusami $575,073 Radiologist The Hospital For Sick Children Richard Geofroy $574,706 Senior Vice President Darlington Ontario Power Generation Robert Myers $573,501 Director Perimeter Institute For Theoretical Physics Wei-Yi (Scott) Liao $570,724 Professor of Accounting University Of Toronto David Goldreich $564,232 Professor of Finance University Of Toronto Name Salary JobTitle Employer George Soleas $563,291 President and Chief Executive Officer / Président-directeur général Liquor Control Board Of Ontario / Régie des alcools de l’Ontario Alan Aspuru-Guzik $562,716 Professor of Chemistry and Computer Science University Of Toronto Richard Leary $562,326 Chief Executive Officer City Of Toronto – Toronto Transit Commission Stephen Scherer $558,624 Chief Research Institute The Hospital For Sick Children Anita Mcgahan $557,594 Professor of Strategic Management University Of Toronto David Kaposi $554,250 Vice President Chief Investment Officer Ontario Power Generation Anthony Tang $550,000 Professor/Medical Doctor University Of Western Ontario Suzanne Laughlin $549,680 Neuroradiologist The Hospital For Sick Children Jane Philpott $546,053 Dean, Chief Executive Officer (Southeastern Ontario Academic Medical Organization), Professor Queen’s University Michael Lindsay $544,897 Chief Executive Officer/Directeur général Ontario Infrastructure And Lands Corporation (Infrastructure Ontario) / Société Ontarienne Des Infrastructures Et De L’Immobilier (Infrastructure Ontario) George Chiramel $543,693 Radiologist The Hospital For Sick Children Sonia Baxendale $540,000 President and Chief Executive Officer Global Risk Institute In Financial Services Thomas Parker $538,300 Executive Vice President Clinical and Chief Medical Officer Unity Health Toronto Heather Ferguson $536,089 Senior Vice President Business Development, Strategy and Corporate Affairs Ontario Power Generation Lynn Guerriero $533,688 President and Chief Executive Officer/Président et chef de la direction Niagara Health System Name Salary JobTitle Employer Joshua Basseches $533,112 Director and Chief Executive Officer/Directeur général Royal Ontario Museum / Musée royal de l’Ontario Alexander Dyck $530,667 Professor of Finance University Of Toronto Moon Hung Wong $530,178 Professor of Accounting University Of Toronto William Strange $527,992 Professor of Economic Analysis and Policy University Of Toronto Mark White $526,815 Chief Executive Officer / Directeur général Financial Services Regulatory Authority of Ontario / Office Ontarien De Réglementation Des Services Financiers Scott Beck $524,615 President and Chief Executive Officer Toronto Convention and Visitors Association Meredith Irwin $524,045 Paediatrician-In-Chief SickKids and Chair Paediatrics, University of Toronto The Hospital For Sick Children Glen Whyte $522,941 Professor of Organizational Behaviour and Human Resource Management University Of Toronto Shelley Babin $522,640 Chief Operating Officer Ontario Power Generation Duncan Stewart $522,502 Executive Vice President/Vice-président exécutif Ottawa Hospital Research Institute Andrea Krystal $521,787 President/Chief Executive Officer Southlake Regional Health Centre Partha Sarat Mohanram $521,203 Professor of Accounting University Of Toronto John Hull $518,747 Professor of Finance University Of Toronto Gerhard Trippen $515,033 Associate Professor, Teaching Stream, Department of Management University Of Toronto Karyn Lynn Popovich $513,011 President And Chief Executive Officer North York General Hospital Name Salary JobTitle Employer Mihnea Moldoveanu $512,922 Professor of Economic Analysis and Policy University Of Toronto Craig Andrew Doidge $512,894 Professor of Finance University Of Toronto Elspeth Murray $512,348 Director (Centre for Entrepreneurship, Innovation and Social Impact), Associate Professor Queen’s University Gail Hunt $510,829 President and Chief Executive Officer Royal Victoria Regional Health Centre Linda Rabeneck $510,307 Vice President, Prevention and Cancer Control/Vice-présidente, Prévention et lutte contre le cancer Ontario Health / Santé Ontario Frank Martino $509,899 President and Chief Executive Officer William Osler Health System Jeff Mainland $509,324 Executive Vice President The Hospital For Sick Children Christopher Lam $506,462 Radiologist The Hospital For Sick Children Christopher Simpson $506,340 Executive Vice President, Clinical Institutes and Quality Programs and Chief Medical Executive/Vice-président directeur, Instituts des services cliniques et programmes pour la qualité, et médecin en chef Ontario Health / Santé Ontario Terence Cunningham $506,205 Vice President Nuclear Projects Ontario Power Generation Mikhail Simutin $505,246 Associate Professor of Finance University Of Toronto Salim Yusuf $504,895 Professor McMaster University Gregory German $503,790 Medical Microbiologist Unity Health Toronto Ole-Kristian Hope $503,423 Professor of Accounting University Of Toronto Michael Manning $502,675 Executive Director and Chief Investment Officer / Directeur général et agent en chef des placements Ontario Financing Authority / Office ontarien de financement Peter Shena $501,937 Executive Vice President and Chief Pension Officer / Vice-président directeur et chef des rentes Ontario Public Service Pension Board (Ontario Pension Board) / Commission Du Régime De Retraite Des Fonctionnaires De L’Ontario (Commission Du Régime De Retraite D) What is Doug Ford’s salary?

Ontario Premier Doug Ford got a salary of $208,974 in 2023, according to the latest Sunshine List Ontario 2024.Who is the highest-paid employee of the Ontario government?

Kenneth Hartwick, CEO of the Ontario Power Generation (OPG), is the highest paid, with an annual compensation of slightly more than $1.9 million in 2023.What is the Sunshine List for Ontario?

Former Progressive Conservative Premier Mike Harris signed the Public Sector Salary Disclosure Act into law in 1996, requiring organizations receiving provincial funding to disclose the names, positions, and salaries of those earning more than $100,000.What is the criteria for Sunshine List Ontario?

Any public sector employee or executive earning more than $100,000 is eligible for the Sunshine List Ontario.

Click here to see the whole list.Article Navigation

sunshine list 2024, sunshine list 2024 release date, when did sunshine list come out, Ontario salary disclosure, Ontario salary disclosure 2023, Ontario public salary disclosure, 2024 sunshine list, ontario.ca sunshine list, kenneth hartwick, sunshine list ontario, sunshine list 2024, new sunshine list, sunshine list ontario 2024, sunshine list canada,

- New GST Payment To Be Sent On April 5

The Canada Revenue Agency (CRA) will be sending out to qualifying Canadian taxpayers their quarterly HST/GST payment on April 5, 2024.

Four times a year, low- and modest-income individuals and families receive the GST/HST credit, which is a non-taxable payment that helps balance the goods and services tax and harmonized sales tax (GST/HST) they pay.

GST Payment Eligibility

You are eligible for this credit if, at the beginning of the month in which the CRA makes a payment, you are considered a resident of Canada for income tax purposes.

Before the CRA sends you a quarterly payment, you have to be at least 19 years old in that month.

You must complete at least one of the following conditions within the same time frame if you are under the age of 19:

1. You are married or have a common-law partner now or in the past.

2. As a parent, you either currently reside with your child or formerly did.

How to Receive Credit for GST/HST

In the event that you did not receive any income in 2022, you still need to file a tax return in order to claim the GST/HST credit and any applicable provincial and territorial credits.

If you are a newcomer to Canada (foreign student, work permit holder, or permanent resident) and arrived in 2023, then you can use one of the two methods stated below to claim the GST/HST credit:

If you’re not a parent,

Send in Form RC151, Application for GST/HST Credit and Climate Action Incentive Payment for Individuals Who Become Residents of Canada, filled out for the year you become a resident of Canada for the purpose of filing taxes.

If you’re a parent,

To apply for all child and family benefits, complete Form RC66, Canada Child Benefits Application, and mail it in.

To submit your citizenship and residency details, as well as your Statement of Income, you must also complete Form RC66SCH, Status in Canada and Income Information for the Canada Child Benefits Application.

What is your maximum HST/GST payment amount?

For the 2022 base year (GST payment period from July 2023 to June 2024), you may be eligible to receive up to:

$496 for a single person

$650: If you are married or have a common-law spouse

$171 for every child under 19 years old.How is the payment of GST/HST computed?

You would have gotten a notification in July 2023 if the CRA determined, after reviewing your 2022 tax return, that you qualify for the GST/HST credit.

This notification includes the details required to calculate the amount of money you will receive, as well as the amount itself.

You can use the official CRA Child and Family Benefits Calculator to estimate how much GST/HST credit you would receive.What days will GST be due in 2024?

CRA uses the data from your previous tax return to calculate the HST/GST payment.

The upcoming CRA payment dates for GST in 2024 are listed below:

April 5, 2024

July 5, 2024

October 4, 2024

If it falls on a Saturday, Sunday, or federal holiday, CRA makes the payment on the final working day prior to the fifth.

You can contact CRA at 1-800-387-1193 if, after 10 working days around the fifth of the above-mentioned timetable, you have not received your payment.When will CRA send the April 2024 GST payment?

The next payment for GST is due on April 5, 2024. Eligible individuals can receive a maximum of $496, couples can receive $650, and families with children can receive an additional $171.What are the Canadian government payments going to Canadian taxpayers in April 2024? are there?

GST payments: April 5, 2024

Canada Carbon Rebate (CCR) (formerly known as Climate action incentive payment): April 15, 2024

Canada Child Benefit (CCB): April 19, 2024What is GST in Canada?

GST, or Goods and Services Tax, is charged to most Canadian purchases and services.

A 5% surcharge applies to groceries, rents, and imports. The CRA administers this tax and they want it to include practically everything from product creation to sales.

The “input tax credit” technique is crucial to GST. This helps firms recover GST on purchases and business expenses. It reduces firms’ tax bills like a credit.

Businesses can offset GST paid with GST earned from sales. Thus, they pay less tax, which benefits them.

The average Canadian taxpayer gets some of this back in the form of a quarterly (after every 3 months) GST rebate payment.Jump Back To Top

gst rebate 2024, new cra gst payments 2024, grocery rebate canada, gst increase 2024, gst payment dates for 2024, gst dates, gst payment, gst canada, gst 2024, gst April 2024, gst payment April 2024, gst 2024, april gst payment, gst hst payment dates, gst calculator, gst payment increase 2024, gst increase 2024,

- New Minimum Wage In Canada and 5 Provinces, Effective April 1

The federal new minimum wage in Canada will rise from $16.65 to $17.30 per hour on April 1, 2024, in order to keep up with inflation.

Consequently, the boost of 65 cents will help around 30,000 Canadian workers working in federally regulated sectors.

All federally regulated private sectors in Canada, such as banking, postal and courier services, interprovincial air, rail, road, and ocean transportation, are required to pay the federal minimum wage.

Additionally, workers in these industries receive a higher rate if the minimum wage in their province or territory is higher than the federal minimum wage.

The Consumer Price Index (inflation) determines the federal minimum wage in Canada each year on April 1st.

Prior to this, on April 1, 2023, the federal minimum wage rose from $15.55 to $16.65.

The minimum wage increase in April 2023 was $1.10, as compared to only a 65 cents increase in 2024.

In addition to the increase in the federal minimum wage in Canada, 5 Canadian provinces will also get a new minimum wage effective April 1, 2024.

new minimum wage in 5 Canadian regions

In addition to the rise in the federal minimum wage, Yukon’s minimum wage will also rise by 82 cents, from $16.77 per hour to $17.59, making it the second-highest minimum wage after Nunavut.

Furthermore, the minimum wage in Nova Scotia will increase to $15.20 per hour from the current hourly rate of $15 per hour.

Also, starting on April 1, 2024, the minimum wage in New Brunswick will increase from $14.75 per hour to $15.30, an increase of 55 cents.

On April 1, 2024, the minimum wage in Newfoundland and Labrador will likewise increase by 60 cents per hour, to $15.60.

Workers in Prince Edward Island (PEI) will also be getting a raise in the April 1 minimum wage hike by 40 cents per hour to $15.40.

Minimum wage in all the Canadian Provinces and Next Raise Schedule

Province / Territory Current hourly Minimum Wage Next Raise Schedule Canada (only federally regulated private sectors) $16.65 $17.30 per hour, effective April 1, 2024 Yukon $16.77 $17.59 per hour, effective April 1, 2024 Newfoundland and Labrador $15.00 $15.60 per hour, effective April 1, 2024 Nova Scotia $15.00 $15.20 per hour, effective April 1, 2024. Prince Edward Island $15.00 $15.40 per hour, effective April 1, 2024 New Brunswick $14.75 $15.30 per hour, effective April 1, 2024 Nunavut $19.00 Yet to be decided British Columbia $16.75 $17.40 per hour, effective June 1, 2024 Ontario $16.55 minimum wage is to be revised on October 1, 2024 Northwest Territories $16.05 Yet to be decided Manitoba $15.30 $15.80 per hour, effective October 1, 2024 Quebec $15.25 $15.75 per hour, effective May 1, 2024 Alberta $15.00 Yet to be decided Saskatchewan $14.00 $15 per hour, effective October 1, 2024 minimum wage in Canada What are the federally regulated private sectors?

- The private aviation industry includes airlines, airports, aerodromes, and aircraft operations.

- banks, including those with international operating permits.

- grain elevators, feed mills, feed storage facilities, and grain-seed washing facilities.

- Indigenous self-governments and band councils for First Nations people are specific activities.

- port services, maritime shipping, ferries, tunnels, canals, bridges, and pipelines (oil and gas) that transcend provincial or international borders

- federal Crown businesses, such as Canada Post Corporation.

- courier and postal services

- highways that cross national or international borders

- certain short-line railroads, and road transportation services such as trucks and buses

- radio and television transmissions,

- communications technologies include cable systems, the Internet, telephones, and telegraphs.

- atomic energy, uranium mining and processing, and

- any other enterprise critical to the execution of any of the aforementioned operations is all in the federally regulated private sector.

- municipalities and private sector businesses in Yukon, the Northwest Territories, and Nunavut (exclusively for Section I of the Code)

When is the minimum wage going up in Ontario in 2024?

The minimum wage in Ontario is going up on October 1, 2024, and details of the amount of increase in the hourly wage rates will be published prior to April 1, 2024.What does the federal minimum wage mean in Canada?

The federal minimum wage in Canada is the lowest wage rate that employers must pay to most workers in the federally regulated public and private sectors, which includes banks, postal services, airlines, etc.What is the federal new minimum wage in Canada as of April 1, 2024?

The new federal minimum wage in Canada as of April 1, 2024, will be $17.30 CAD per hour, an increase of 65 cents from the current minimum wage of $16.65 CAD per hour.How often does the federal minimum wage adjust in Canada?

The federal minimum wage in Canada is adjusted annually on April 1st to keep pace with inflation and maintain fair compensation for workers working in federally regulated sectors such as banking, postal and courier services, and interprovincial air, rail, road, and maritime transportation.What is the highest minimum wage in Canada?

$19 CAD per hour in Nunavut is the highest minimum wage in Canada, followed by Yukon at $16.77 and British Columbia at $16.75.

Jump Back to Top

federal minimum wage in Canada, minimum wage manitoba, minimum wage nova scotia, minimum wage ontario 2024, minimum wage across Canada, ontario minimum wage, minimum wage 2024, minimum wage bc (british columbia), ontario minimum wage 2024, minimum wage in canada, new minimum wage ontario, new minimum wage ontario 2024, new minimum wage 2024, minimum wage quebec, minimum wage nb, minimum wage toronto, minimum wage vancouver, new minimum wage in canada, minimum wage in canada, minimum wage canada, minimum wage canada 2024,

- New Canada Carbon Tax Increase Effective April 1

The Canada Carbon Pricing Plan will increase from $65 per tonne to $80 per tonne effective April 1, adding to the rise in gas prices.

This increase of $15 per tonne will continue until it reaches $170 per tonne by 20230. The current Canada carbon pricing plan is $65 a tonne.

Previously known as the climate action incentive payment, the Canada Carbon Rebate is a component of the government’s carbon pricing scheme.

Quarterly tax-free payments are sent to qualified Canadians, with the next payment scheduled for April 15, 2024, under a program that the federal government rebranded in February 2024.

Only the Northwest Territories, Quebec, and British Columbia have established their own carbon pricing schemes; federal carbon pricing and rebates are not applicable to them.

Experts anticipate that the April 1 raise will add around three cents to the cost of gasoline at the pumps.

Rebranding of Climate Action Incentive Payment (CAIP)

On February 14, the Department of Finance announced new, higher Carbon Tax Rebate 2024 payments, rebranding the previously known Climate Action Incentive Payment (CAIP).

The agency also formally announced the CCR 2024 payment dates and amounts based on province of residence.

According to the Finance Ministry, the name has been changed to the Canada Carbon Rebate to explain its purpose and make the meaning and relationship with the carbon pricing plan more accessible to Canadians.

In provinces where the federal fuel levy applies, a family of four can receive up to $1,800 from the basic CCR in 2024–25.

Carbon pricing is currently in force in Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador.

Residents in these provinces will receive the first of four quarterly CCR payments in April 2024, with the remaining installments slated for July 2024, October 2024, and January 2025.

How much do Canadians get as a carbon rebate?

Beginning in April, a family of four can get a CCR payment of up to:

Alberta: $1,800 ($450 quarterly);

Manitoba: $1,200 ($300 quarterly);

Ontario: $1,120 ($280 quarterly);

Saskatchewan: $1,504 ($376 quarterly);

New Brunswick: $760 ($190 quarterly);

Nova Scotia: $824 ($206 quarterly);

Prince Edward Island: $880 ($220 quarterly); and

Newfoundland and Labrador: $1,192 ($298 quarterly).

Beginning 2024–25, rural Canadians will get a 20% boost in the base Canada Carbon Rebate in recognition of their higher energy usage and limited access to cleaner transportation options.

Opposition of Canada Carbon Pricing

The federal Conservatives have long denounced carbon pricing, with Conservative Party Leader Pierre Poilievre threatening to repeal it if his party wins power in the next election.

Provincial leaders, including Newfoundland and Labrador Liberal Premier Andrew Furey, are calling for a halt over affordability concerns.

In a letter to Trudeau, Furey stated that, while his administration is “deeply invested” in environmental sustainability, the projected rise “is causing understandable worry as people consider how they will manage the mounting financial strain.”

Ontario Progressive Conservative Premier Doug Ford, Alberta United Conservative Premier Danielle Smith, and Saskatchewan Premier Scott Moe, who leads the conservative Saskatchewan Party, all endorsed Furey’s appeal by publishing the letter to their own X accounts on Tuesday.

Manitoba’s NDP Premier, Wab Kinew, has also stated that he would like to reconsider how federal carbon pricing is imposed in the province, although any changes might take up to three years to implement.

What are the Canada carbon rebate (CCR) payment dates?

The CCR payment is made quarterly, with the following issuance dates:

April 15, 2024

July 15, 2024

October 15, 2024

January 15, 2025

ccr payment, carbon tax, carbon tax rebate 2024, carbon tax increase 2024, next carbon tax payment, carbon tax protest, Doug Ford carbon tax, Trudeau carbon tax increase, carbon tax rebate payments 2024, Canada immigration news, Latest Canada news,

- New Canada Visa Requirement For Mexicans, Effective Feb 29

New Canada Visa Requirement for Mexicans: Mexican citizens will require a visa to enter Canada effective February 29, 2024, at 11:30 p.m. EST, unless they meet specified criteria.

This is in response to a rise in asylum petitions filed by Mexican citizens that are denied, withdrawn, or abandoned.

These modifications apply even if you’ve already booked your trip.

As per the IRCC, having pre-booked travel reservations or a previously valid eTA does not ensure approval for a new eTA or visa.

Most current electronic travel authorizations (eTAs) for Mexican passport holders are being cancelled.

Mexican citizens can reapply for a new eTA if they fly to Canada and:

- holding a visitor visa to Canada in the last ten years,

- or

- currently possess a valid nonimmigrant visa to the United States. Otherwise, they require a visa.

However, the application process for Mexican citizens seeking work or study permits will remain unchanged.

Mexican citizens with valid Canadian employment or study permits are unaffected.Their eTA will not be cancelled, and they will be able to continue travelling to Canada.

Mexican citizens without a valid work or study permit who are already in Canada may stay for as long as they are permitted, but their eTA will be terminated.

If they leave Canada and want to return, they must get a visa or a new eTA, if eligible.

Mexican visitors may face delays when arriving at Canadian airports owing to changed entrance regulations.

Why the New Canada Visa Requirement for Mexicans?

Asylum requests filed by Mexican citizens hit a new high in 2023, at a time when Canada’s asylum system, housing, and social services were already under strain.

The majority of these petitions (about 60%) were either denied by the Immigration and Refugee Board of Canada or withdrawn or abandoned by the applicant.

In 2023, asylum petitions from Mexican residents accounted for 17% of all claims made that year by all nationalities worldwide.

The number of asylum requests in the country has increased dramatically since the visa was initially lifted in 2016 (from 260 in 2016 to 23,995 in 2023).

Important points to be aware of

All eTAs granted to Mexican passport holders before 11:30 p.m. Eastern time as of February 29, 2024, will be invalid—with the exception of eTAs linked to Mexican passports with a valid Canadian work or study permit.

Mexican citizens who travel to Canada without a valid employment or study permit must apply for a visitor visa or reapply for a new eTA—if qualified.

Mexican travellers in Canada on an eTA can stay for as long as they are authorized (up to six months from the date of arrival).

However, if they intend to leave Canada and return, they must have the appropriate travel documents (visa or fresh eTA).

Most successful visa applicants are granted multiple-entry visas, which allow them to visit Canada as often as they wish for up to ten years, or until their passport expires.

What is Canada eTA?

The eTA is a digital travel document required for most visa-exempt passengers to enter or transit through Canada by air.

In 2017, IRCC began expanding its eTA program to include qualified individuals from visa-required nations. Mexico will now be one of 15 nations whose citizens can fly to Canada with an eTA instead of a visa if they meet specific standards.As of February 29, 2024 at 11:30 PM EST, Mexican citizens will need a visa to enter Canada unless they meet certain criteria. Most existing electronic travel authorizations (eTAs) for Mexican passport holders are being cancelled. https://t.co/paSAsg2jxX

— IRCC (@CitImmCanada) February 29, 2024

Mexican citizens may… pic.twitter.com/fMYoMkFRQ5What are the new eTA or visitor visa requirements for Mexicans?

Effective at 11:30 p.m. ET (Toronto time) on February 29, 2024, to be eligible for an eTA, Mexicans must meet new requirements.

If Mexicans already have an eTA, it will be automatically cancelled unless they have a valid work or study permit.

If they have an eTA application in progress, they will need to apply for a new eTA or a visitor visa before travelling to Canada (if eligible).

If they are no longer eligible for an eTA, they will have to apply for a visitor visa to come to Canada.

Canada immigration news, immigration news canada, new ircc update, new ircc news,

- holding a visitor visa to Canada in the last ten years,

- Top 10 Most Dangerous Cities in Canada 2024 | New List

Most dangerous cities in Canada for 2024: Canada is renowned for its breathtaking natural beauty, hospitable charm, and kind people.

But there is crime, just as in every other nation. In spite of this, Canada continues to rank among the safest nations in the world thanks to its comparatively low crime rate.

The crime index provides a severity-weighted statistic by quantifying the relative frequency and seriousness of crimes in various regions of Canada.

According to the global statistics database Numbeo, eight Canadian cities are among the top 100 cities in the world with the highest crime index.

The “Crime Index,” which evaluates the overall amount of crime over the preceding 36 months, is taken into consideration while ranking each position.

Areas with scores between 20 and 40 are seen as having low crime rates, while those with scores below 20 are thought to have extremely low crime rates.

Comparably, locations scoring between 40 and 60 are thought to have moderate crime rates, while those scoring between 60 and 80 are thought to have high crime rates.

It is believed that areas with scores of 80 or higher have noticeably higher rates of crime.

Every city is also assigned a “Safety Index” that rates the level of risk to both residents and tourists.

It’s important to remember that, in comparison to other nations, Canada still has comparatively low crime rates, even in its most violent cities.

Thus, even though it’s critical to be aware of these situations, it’s equally critical to keep in mind that Canada is still a generally secure place.

It’s crucial to be aware of your surroundings and well-informed if you plan to move to or visit Canada.

You may take advantage of everything Canada has to offer while remaining safe and secure by doing this.

8 Most Dangerous Cities in Canada for 2024

The top 100 cities in the world with the highest crime index include eight high-risk Canadian cities.

1. Surrey, British Columbia: With a substantial surge in drug-related offences such as possession with and without intent to distribute, Surrey has an overall crime index of 64.28, which has increased from 63.8 in 2023.

The majority of these assaults in Surrey have increased significantly due to drug use.

2. Lethbridge, Alberta: Lethbridge’s overall crime index is 62.3, slightly higher than the 62.3 in 2023, with a violent crime rate of 57.74.

The most frequent crimes are those involving drugs and the continuing opioid crisis.

3. Kelowna, British Columbia: With a crime index of 61.57, a violent crime rate of 56.91, and a safety index of 38.43, Kelowna is the third most dangerous city in Canada.

This is significantly higher than the norm for the largest cities in British Columbia. Theft and vandalism are the most often reported crimes both inside and outside of Kelowna’s metropolitan region.

4. Red Deer, Alberta: With a crime index of 62.88, a violent crime rate of 57.38, and a safety index of 37.12, Red Deer continues to have a high crime rate.

In 2023, Red Deer had an above-average crime index of 61.2, many points more than the norm for Alberta.

5. Sudbury, Ontario: The VCSI reports that while violent crimes have grown in Sudbury over the past three years, petty crimes have been gradually falling.

The crime index for Sudbury is 60.46, which is actually lower than 60.7 as reported in 2023.

Sudbury had Canada’s fourth-highest homicide rate in 2021.

6. Sault Ste. Marie: The city’s crime index has increased from 59.2 in 2023 to 60.28 in 2024 with reports of theft and aggravated assault.

Sault Ste. Marie is a city in Ontario, Canada, that connects with the U.S. via a bridge border near three Great Lakes.

7. Oshawa, Ontario: With a crime index of 59.34, Oshawa saw a significant rise in crime index as compared to 55.08 in 2023.

This city, which is home to multiple automakers and is dubbed the “automotive capital of Canada,” still has a moderate incidence of crime.

Though it is regarded as one of Canada’s liveliest cities, it has comparatively high rates of petty theft and vandalism, which are frequently connected to drug use and distribution.

Furthermore, drug-related offences like drug usage and trafficking are a common threat, and vandalism is another issue that should worry people in the region.

8. Winnipeg, Manitoba: This city has the second-highest murder rate in Canada, in addition to a high overall crime index of 60.09, an increase of more than 1 point from 58.9 in 2023.

Winnipeg panorama at sunset. Winnipeg, Manitoba, Canada While drug and gang-related activities are the primary cause of killings in Winnipeg, other typical crimes include assaults, robberies, and muggings.

Major Canadian Cities with Crime and Safety Index

City Crime Index Safety Index Surrey 64.25 35.75 Red Deer 62.88 37.12 Lethbridge 62.55 37.45 Kelowna 61.6 38.4 Sudbury 60.5 39.5 Sault Ste. Marie 60.3 39.7 Winnipeg 60.1 39.9 Oshawa 59.34 40.66 Hamilton 54.9 45.1 Nanaimo 52.7 47.3 Saskatoon 50.3 49.7 Edmonton 46.4 53.6 Windsor 45.2 54.8 Mississauga 43.5 56.5 Toronto 43.1 56.9 Kitchener 42.3 57.7 Vancouver 42.0 58.0 Victoria 41.2 58.8 Halifax 40.9 59.1 Calgary 38.2 61.8 Guelph 34.4 65.6 Montreal 32.0 68.0 Ottawa 31.5 68.5 Oakville 26.1 73.9 Quebec City 22.0 78.0 Major Canadian Cities with Crime and Safety Index Which city has the highest crime rate in Canada in 2024?

Surrey has the highest crime index of 64.25 in 2024, as reported by users on Numbeo, followed by Red Deer (62.88), Lethbridge (62.55) and Kelowna (61.6).What is the safest city in all of Canada among the major Canadian populous areas?

Quebec City has the highest safety index of 78.0 among all the major Canadian cities, followed by Oakville with a safety index of 73.9.What are the most dangerous cities in the world in 2024?

Venezuela’s capital, Caracas, is still regarded as one of the world’s most dangerous cities. Its low safety ratings and high crime rates have earned it notoriety.

Following Caracas, South African cities with safety scores of 19 or lower, including Pretoria, Durban, and Johannesburg, have also been classified as exceedingly dangerous locations.

It is also well known that there is a high crime rate in these cities.What are the most dangerous cities in Ontario in 2024?

Although most of Canada is secure, certain cities have high rates of crime. The eight most hazardous cities in Ontario are as follows:

Sudbury

Sault Ste. Marie

Oshawa

Hamilton

Windsor

Mississauga

Toronto

Kitchener

most dangerous cities in canada, cities in canada, most dangerous cities in canada 2024, top 10 most dangerous cities in canada 2024, 20 most dangerous cities in canada, Canada immigration news, immigration news canada,